The global black pepper market is transitioning from a cyclical oversupply-driven commodity into a structurally constrained agricultural asset, reshaping its risk–return profile for investors, traders, and agribusiness participants.

Unlike previous cycles characterized by rapid acreage expansion and sharp price collapses, the current pepper market is increasingly defined by limited supply elasticity, rising production costs, and long-term land-use competition. These factors collectively support a higher price floor and reduce downside volatility.

Structural Supply Tightness: A New Normal

At the core of the investment thesis lies structural supply tightness.

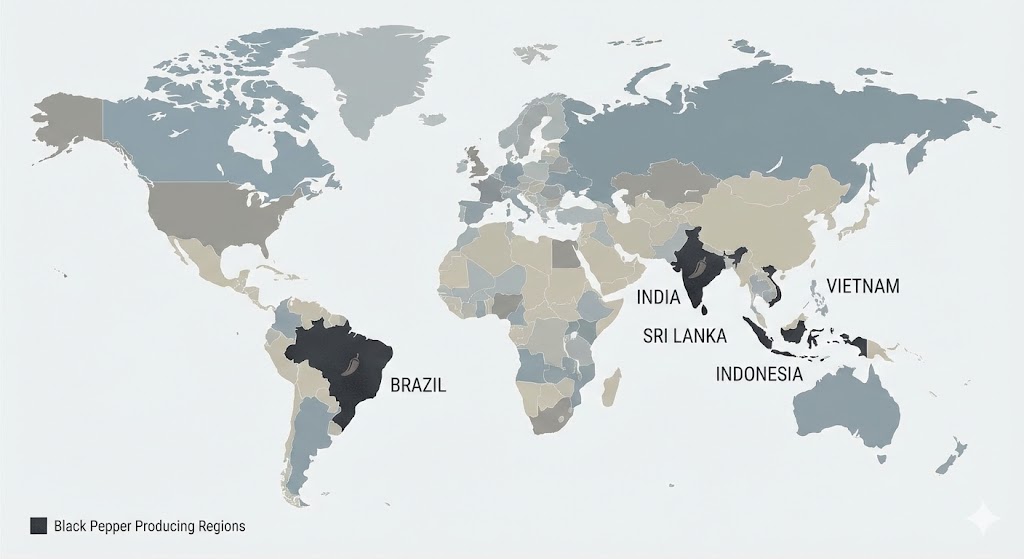

Pepper cultivation is highly labor-intensive, slow to replant, and sensitive to climate variability. Across major producing countries — Vietnam, Brazil, Indonesia, India, and Sri Lanka — growers face a combination of aging vines, limited access to capital, and declining economic incentives compared with alternative crops.

Vietnam’s pepper area has contracted steadily over the past five years as farmers pivot toward higher-margin fruit and coffee cultivation. Even with higher pepper prices, replanting has remained limited due to long gestation periods and agronomic risks.

Brazil offers the strongest expansion potential, but yield growth remains uneven and capital-intensive. Indonesia and India face similar constraints, while Sri Lanka’s output remains structurally impaired.

From an investor perspective, this lack of rapid supply response significantly alters the commodity’s behavior. Pepper is no longer prone to sudden oversupply shocks — a key difference from grains or soft commodities with short planting cycles.

Cost Inflation and the Price Floor

Production economics have shifted materially.

Fertilizers, crop protection inputs, labor, and financing costs have all increased structurally since 2020. These higher costs raise the breakeven level for farmers and exporters, effectively embedding a price floor into the market.

Importantly, pepper growers have demonstrated a higher willingness to delay sales when prices fall below cost-reflective levels. This behavior reduces forced selling and dampens downside volatility — a favorable dynamic for investors seeking stability.

For agribusiness firms and traders, higher costs also discourage speculative stock accumulation, further reinforcing disciplined supply behavior.

Demand: Defensive, Not Explosive

Pepper demand lacks the cyclical acceleration seen in energy or industrial metals, but this is precisely what enhances its defensive characteristics.

Consumption is anchored in food processing, seasoning, and household staples — sectors with relatively inelastic demand. Even during economic slowdowns, pepper usage tends to decline modestly rather than collapse.

In mature markets such as the U.S. and Europe, consumption growth is stable but slow. In emerging markets, population growth and urbanization provide incremental upside, though price sensitivity remains a constraint.

China’s recovery trajectory remains important. While not yet a growth engine, gradual normalization in foodservice demand adds optionality to the upside.

From an investor standpoint, this profile supports steady cash flows rather than speculative demand spikes.

Trade, Currency, and Margin Dynamics

Currency movements play an outsized role in pepper pricing.

A weaker Vietnamese dong or Brazilian real can temporarily increase export competitiveness, benefiting exporters while stabilizing global prices. Conversely, a strong U.S. dollar compresses importer margins and slows buying.

For investors exposed to pepper through equities, private agribusiness holdings, or physical trade finance, currency hedging becomes a critical performance driver.

Margins across the value chain have improved relative to the 2017–2020 period, particularly for exporters with strong sourcing relationships and logistics efficiency.

ESG, Traceability, and Capital Allocation

Environmental, social, and governance (ESG) considerations are increasingly relevant.

Large buyers now demand traceability, residue compliance, and sustainable sourcing — raising entry barriers for smaller exporters but benefiting well-capitalized firms.

For investors, this creates differentiation opportunities:

- Exporters with compliance capabilities

- Origin operators with integrated sourcing

- Firms positioned to monetize sustainability premiums

Pepper’s perennial nature also aligns with long-term land stewardship models, further enhancing its ESG narrative.

Bull, Base, and Bear Scenarios

Bull Case (Low Probability, High Impact)

- Severe climate disruption in Southeast Asia

- Further acreage contraction in Vietnam

- Demand recovery in China and emerging markets

Outcome: Prices move sharply higher, exporters and origin-linked assets outperform, volatility increases but remains supply-driven.

Base Case (Highest Probability)

- Supply remains structurally tight

- Demand grows slowly but steadily

- Costs maintain a firm price floor

Outcome: Prices trade in an elevated range with limited downside, favoring carry strategies, structured trade finance, and integrated agribusiness investments.

Bear Case (Low Probability)

- Global recession reduces foodservice demand

- Temporary supply rebound from Brazil

- Strong U.S. dollar suppresses imports

Outcome: Prices soften but remain above historical lows due to cost support and farmer selling discipline.

Investment Implications

Pepper should be viewed less as a trading vehicle and more as a defensive agricultural exposure.

Opportunities exist in:

- Export-oriented agribusiness equities

- Physical trade finance with inventory control

- Private investments in origin processing and compliance

The absence of liquid futures markets limits pure financial speculation but enhances the role of structured products and physical exposure.

Conclusion: A Mature, Disciplined Market

The global pepper market has entered a phase of maturity defined by constrained supply, disciplined selling, and defensively anchored demand.

For investors, this represents a shift from boom–bust volatility toward sustained tightness — an attractive profile in a world increasingly defined by climate risk, cost inflation, and food security concerns.

Pepper may not deliver explosive upside, but it offers something increasingly rare in commodity markets: predictability with optionality.