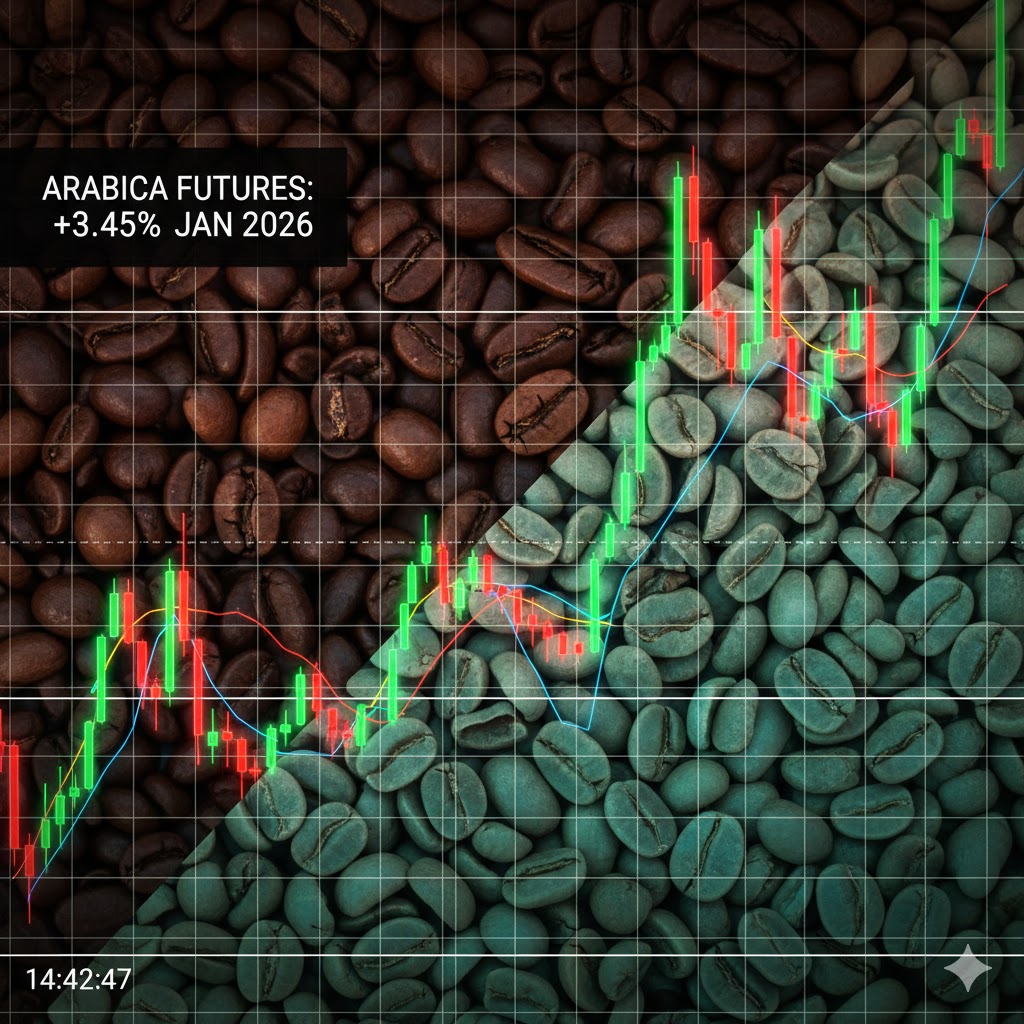

After weeks of upward momentum, Arabica coffee prices have entered a phase of consolidation. The market, once driven by fears of tightening supply and weather disruptions in key producing regions, is now stepping back to reassess a more nuanced reality: the possibility that global coffee supplies may prove more ample than previously expected.

This pause does not signal a structural reversal. Instead, it reflects a classic commodity market dynamic — where price rallies fueled by risk premiums eventually collide with updated expectations about production, inventories, and forward supply.

A Rally Meets Resistance

Arabica futures on ICE New York recently pulled back after reaching multi-week highs. The rally had been supported by a familiar cocktail of concerns: lingering drought risks in Brazil, uneven flowering conditions, and historically low certified inventories earlier in the season.

However, as prices climbed, the narrative began to shift. Traders and analysts started questioning whether the market had already priced in worst-case supply scenarios — scenarios that may not fully materialize if upcoming harvests meet revised expectations.

Profit-taking emerged, volatility softened, and the market entered a wait-and-see mode.

Weather Risks Ease — For Now

Brazil, the world’s largest producer of Arabica coffee, remains the single most important variable in the global pricing equation. Earlier fears centered on prolonged dryness in key growing regions such as Minas Gerais and São Paulo, raising alarms about yield potential for the next crop cycle.

More recent weather forecasts, however, point to improved rainfall patterns. While far from perfect, these conditions have reduced immediate stress on coffee trees and improved prospects for bean development.

This does not eliminate weather risk — coffee remains highly sensitive to timing, rainfall distribution, and temperature extremes — but it does temper the most aggressive supply-loss assumptions that fueled earlier price gains.

Markets are now recalibrating expectations rather than reacting to outright panic.

Supply Expectations Begin to Shift

Beyond weather, broader supply fundamentals are beginning to weigh on sentiment.

Brazil’s Production Outlook

Early projections for Brazil’s upcoming coffee crop suggest a recovery from prior weather-affected seasons. Even a partial rebound in output would significantly alter the global balance sheet, given Brazil’s dominant share of Arabica exports.

A stronger harvest would increase export availability in the second half of the year, easing pressure on roasters and traders who have been operating under tight procurement conditions.

Vietnam and the Global Balance

While Vietnam is primarily a Robusta producer, its role in global coffee supply cannot be ignored. Rising Robusta availability often influences blending strategies and price relationships across the coffee complex.

Strong shipments from Vietnam add to the perception that overall coffee supply — across varieties — may be less constrained than feared, indirectly reducing speculative pressure on Arabica contracts.

Inventories Send a Subtle Signal

Certified Arabica stocks monitored by ICE had previously fallen to levels that reinforced the bullish narrative. More recently, inventories have shown signs of stabilization, if not outright recovery.

While stock levels remain historically low compared with long-term averages, even a modest increase changes the psychological backdrop of the market. Traders are less inclined to chase prices higher when there is evidence — however limited — that supply chains are gradually replenishing.

In commodity markets, perception often matters as much as volume.

Currency Effects Add Another Layer

The Brazilian real has also played a role in shaping price behavior. A softer real against the U.S. dollar tends to encourage exports, as local producers receive more favorable returns when selling coffee internationally.

When currency dynamics align with improved supply expectations, the incentive to hold coffee off the market diminishes — further capping price advances.

What This Means for Market Participants

The current pause in Arabica prices reflects a transition from fear-driven buying to fundamentals-driven analysis.

- Producers may view this phase as an opportunity to hedge future output while prices remain historically attractive.

- Roasters and importers gain temporary relief, with less urgency to lock in coverage at elevated levels.

- Investors and speculators are increasingly selective, focusing on data rather than narratives.

Volatility has not disappeared — it has merely shifted into a different register.

Risks Remain Beneath the Surface

Despite improved outlooks, the coffee market remains structurally vulnerable.

Weather anomalies can re-emerge with little warning. Logistics disruptions, labor constraints, or policy changes in producing countries could quickly revive supply-side anxiety. Demand, meanwhile, has proven resilient, particularly in emerging markets and specialty segments.

As a result, the current consolidation should not be mistaken for complacency.

Conclusion: A Market Catching Its Breath

Arabica coffee’s recent price pause is best understood as a moment of recalibration rather than exhaustion. After climbing on supply fears, the market is now weighing evidence that global production may be sufficient to prevent a prolonged shortage.

The balance between optimism and caution will define price direction in the months ahead. For now, Arabica is catching its breath — waiting for confirmation from weather patterns, harvest data, and inventory flows.

In a market as weather-dependent and globally interconnected as coffee, certainty remains elusive. And that uncertainty, more than any single data point, will continue to shape price behavior through 2026.