The global black pepper market is entering 2026 under renewed supply pressure, as production shortfalls across key origins collide with early signs of demand stabilization in major consuming regions, according to traders and industry data.

Pepper prices, which have trended higher since late 2024, remain supported by structurally tighter supply, climate-related yield losses, and restrained farmer selling, even as global inflation and currency volatility continue to influence trade flows.

Supply Outlook: Structural Constraints Persist

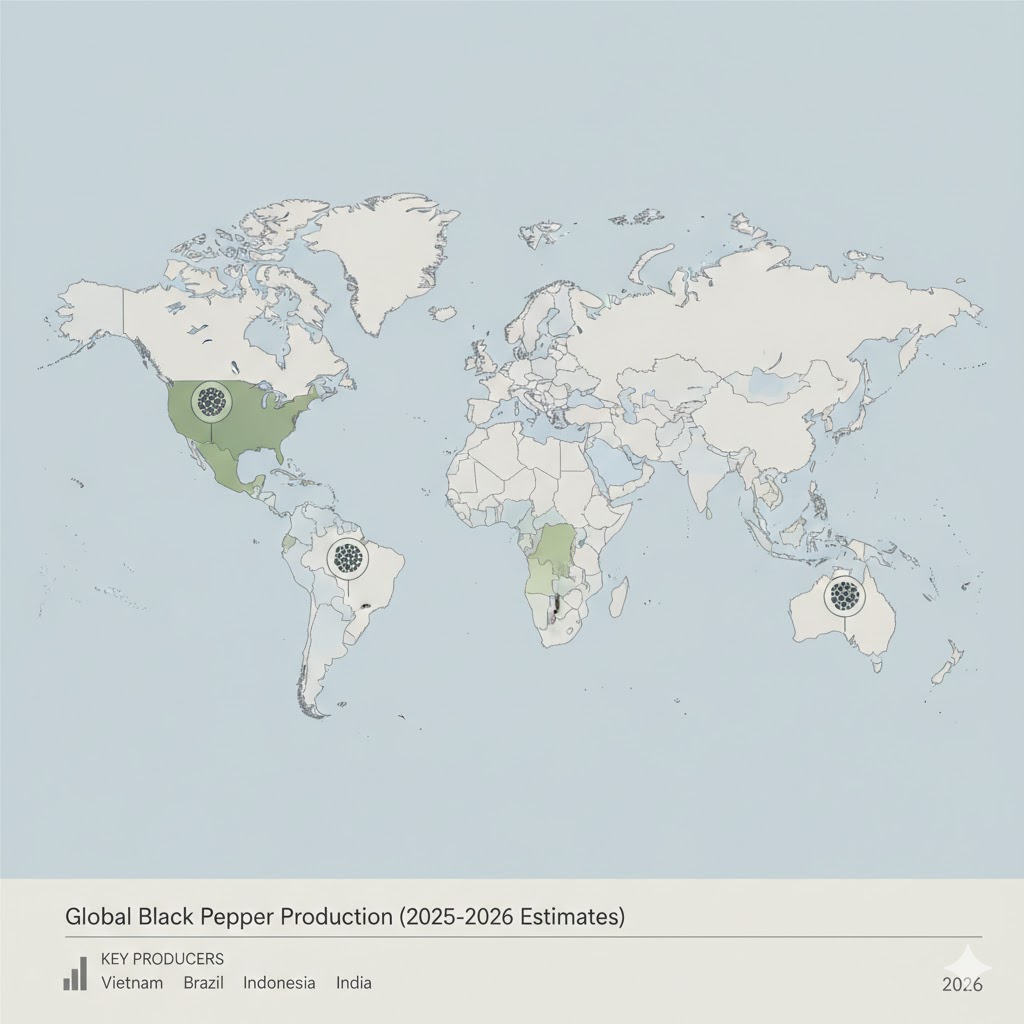

Global pepper production remains heavily concentrated, with Vietnam, Brazil, Indonesia, India, and Sri Lanka accounting for the majority of export volumes. However, output across several of these origins has failed to recover to pre-2020 levels.

Vietnam — the world’s largest pepper exporter — continues to face declining planted area as farmers shift land to more profitable crops such as durian, coffee, and avocado. Industry estimates suggest Vietnam’s pepper output in the 2025/26 season could remain 10–15% below its historical peak, despite modest improvements in farm-gate prices.

Brazil’s production outlook is mixed. While Espírito Santo and Pará have expanded acreage, irregular rainfall and higher input costs have capped yield growth. Exporters note that Brazilian pepper remains price-competitive but increasingly sensitive to currency fluctuations and logistics costs.

In Indonesia and India, smallholder production remains constrained by aging vines, limited replanting, and rising labor costs. Meanwhile, Sri Lanka’s output continues to struggle with fertilizer availability and weather disruptions.

“Pepper is no longer a volume-driven commodity,” said one Singapore-based trader. “It is increasingly defined by supply discipline and higher marginal costs.”

Climate Risk and Cost Inflation

Extreme weather remains a defining variable. Prolonged dry spells followed by intense rainfall episodes have increased disease pressure and reduced productivity in Southeast Asia.

At the same time, growers face structurally higher costs for fertilizers, plant protection chemicals, and labor. These costs have raised the effective floor price at which farmers are willing to sell, reducing downside risk even during periods of weak demand.

As a result, traders say the market has become less responsive to short-term demand shocks compared with previous cycles.

Demand: Gradual Recovery, Not a Surge

On the demand side, consumption remains steady rather than explosive.

The United States and Europe continue to dominate import demand, supported by food processing, ready-to-eat meals, and seasoning blends. While inflation has moderated, buyers remain cautious, purchasing hand-to-mouth and avoiding long inventory positions.

In China, pepper demand has shown gradual recovery alongside foodservice normalization, though volumes remain below pre-pandemic levels. Importers continue to favor competitive pricing and flexible delivery terms.

Emerging markets in the Middle East and South Asia are showing incremental growth, driven by population expansion and urban consumption, but price sensitivity remains high.

“There is no demand boom, but there is no collapse either,” said a European spice buyer. “That stability is enough to keep prices supported in a tight supply environment.”

Trade Flows and Price Dynamics

Global pepper prices in early 2026 remain elevated compared with the five-year average, with black pepper prices trading in a higher band due to limited origin availability and cautious farmer selling.

Vietnamese exporters report thinner export volumes but improved margins, while Brazilian shipments have gained market share in price-sensitive destinations.

Currency movements remain a key factor. A weaker Vietnamese dong or Brazilian real could temporarily boost export competitiveness, while a stronger U.S. dollar continues to pressure importers’ purchasing power.

Logistics costs, while off their pandemic highs, remain structurally higher than pre-2020 levels, further reinforcing price floors.

Market Structure Shifts

Industry participants point to a longer-term structural shift in the pepper market:

- Reduced speculative oversupply

- Greater concentration among exporters

- Increased role of sustainability, traceability, and food safety compliance

- Higher financing costs limiting inventory accumulation

These factors have reduced volatility on the downside, even if upside rallies remain capped by cautious demand.

Outlook: Firm Bias with Limited Upside

Looking ahead, analysts expect the global pepper market in 2026 to maintain a firm-to-stable price bias, underpinned by tight supply and disciplined selling.

Significant price corrections appear unlikely unless there is a sharp global economic slowdown or a sudden production rebound — scenarios traders currently view as low probability.

Upside potential, however, may remain limited by cautious importer behavior and the absence of a strong consumption surge.

“The pepper market has matured,” said one commodities analyst. “It is no longer about spikes and crashes, but about sustained tightness.”