By Market Analysis Desk

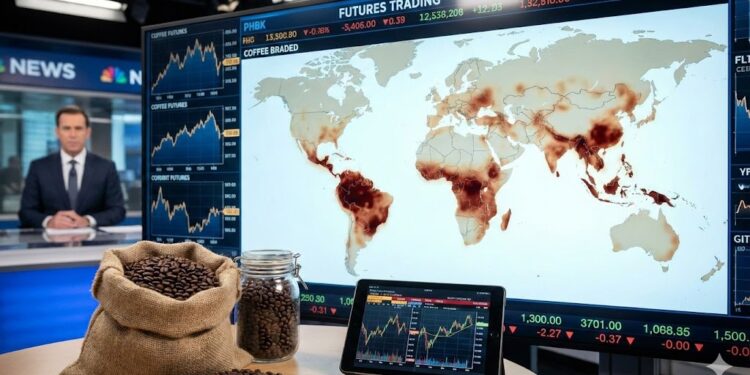

The global coffee market is expected to enter a transitional phase in 2026, as supply recovers from years of weather-driven disruptions, easing tightness that pushed prices to multi-year highs. However, analysts warn that volatility is likely to remain elevated, supported by climate risks, structural cost inflation and shifting consumption patterns.

Supply outlook: Recovery underway, but uneven

Global coffee output is forecast to rise in the 2025/26 and 2026/27 seasons, led by a recovery in Brazil following adverse weather in previous years. Higher prices over the past two seasons have encouraged better farm maintenance and investment across key producing regions.

Brazil’s production cycle is expected to improve, while robusta output from Vietnam and Indonesia is also projected to increase, adding relief to global supplies. That said, market participants caution that weather variability — including drought risks and irregular rainfall – continues to pose downside risks to yield stability.

Despite expectations of a modest surplus, inventories remain historically tight, limiting the market’s ability to absorb supply shocks.

Demand growth slows but remains resilient

Global coffee consumption is expected to grow at a slower but steady pace in 2026, with demand driven largely by emerging markets in Asia-Pacific. China, India and Southeast Asia continue to record rising coffee penetration, offsetting mature consumption patterns in the United States and Europe.

In developed markets, demand growth is increasingly value-driven rather than volume-based, with consumers shifting toward premium, specialty and ready-to-drink coffee products.

Price outlook: Correction expected, but floors remain high

Arabica prices are forecast to ease from recent peaks as supply conditions improve, though analysts do not expect a return to pre-pandemic averages. Elevated production costs, tighter sustainability standards and climate-related risks are likely to underpin prices.

Robusta prices may face additional pressure from increased Asian supply, but remain supported by strong demand from the instant coffee sector and continued substitution away from higher-priced arabica.

Overall, the market is expected to trade with wide price swings in 2026, reflecting sensitivity to weather updates, currency movements and export flows.

Structural shifts reshape the industry

Several long-term trends are expected to define the coffee market beyond 2026:

- Supply chain restructuring: Roasters and traders are increasingly securing long-term contracts to reduce exposure to spot market volatility.

- Sustainability requirements: Environmental and social compliance is becoming a baseline requirement rather than a premium feature.

- Market segmentation: The gap between bulk commercial coffee and high-quality specialty coffee continues to widen, with distinct pricing dynamics.

Risks to watch

Key downside and upside risks for 2026 include:

- Extreme weather events in major producing regions

- Trade policy changes and logistical disruptions

- Currency volatility impacting export competitiveness

- Financial pressure on smallholder farmers amid rising input costs

Any of these factors could trigger sharp short-term price movements despite a more balanced supply outlook.

Conclusion

While the global coffee market in 2026 is expected to be less supply-constrained than in recent years, it remains far from stable. Prices are likely to stay structurally higher, with volatility driven by climate uncertainty and evolving demand patterns. For producers, traders and investors, adaptability and risk management will be critical in navigating the next phase of the coffee cycle.